The main aim of planning your estate is to ensure that as much of the accumulated wealth is utilised for your own benefit and for the benefit of your dependents on your death.

What is estate planning?

“Estate planning” has been defined as the process of creating and managing a programme that is designed to:

- Preserve, increase and protect your assets during your lifetime;

- Ensure the most effective and beneficial distribution thereof to succeeding generations.

It is a common misconception that it revolves solely around the making of a Last Will and Testament, or the structuring of affairs so as to reduce estate duty. Each person’s estate is unique and should be structured according to his/her own unique set of circumstances, goals and objectives.

What is liquidity?

The lack of liquidity on the date of death may cause for the deceased’s family members and dependents to suffer hardship, as certain assets might be sold by the executor to generate the cash needed.

Liquidity means that there should be enough cash funds to provide for:

- Paying estate duty;

- Settling estate liabilities and administration costs;

- Providing for other taxation liabilities that may arise at death, such as capital gains tax.

Technically the estate is frozen until such time as the Master of the High Court has issued Letters of Executorship.

Having no will…

If you die without executing a valid Last Will and Testament, your estate will be dealt with as an intestate estate, and the laws relating to intestate succession will apply. The Intestate Succession Act determines that the surviving spouse will inherit the greater of R250 000 or a child’s share. A child’s share is determined by dividing the total value of the estate by the number of the children and the surviving spouse. If the spouses were married in community of property, one half of the estate goes to the surviving spouse as a consequence of the marriage, and the other half devolves according to the rules of intestate succession. If there is no surviving spouse or dependents, the estate is divided between the parents and/or siblings. In the absence of parents or siblings, the estate is divided between the nearest blood relatives.

The executor remuneration

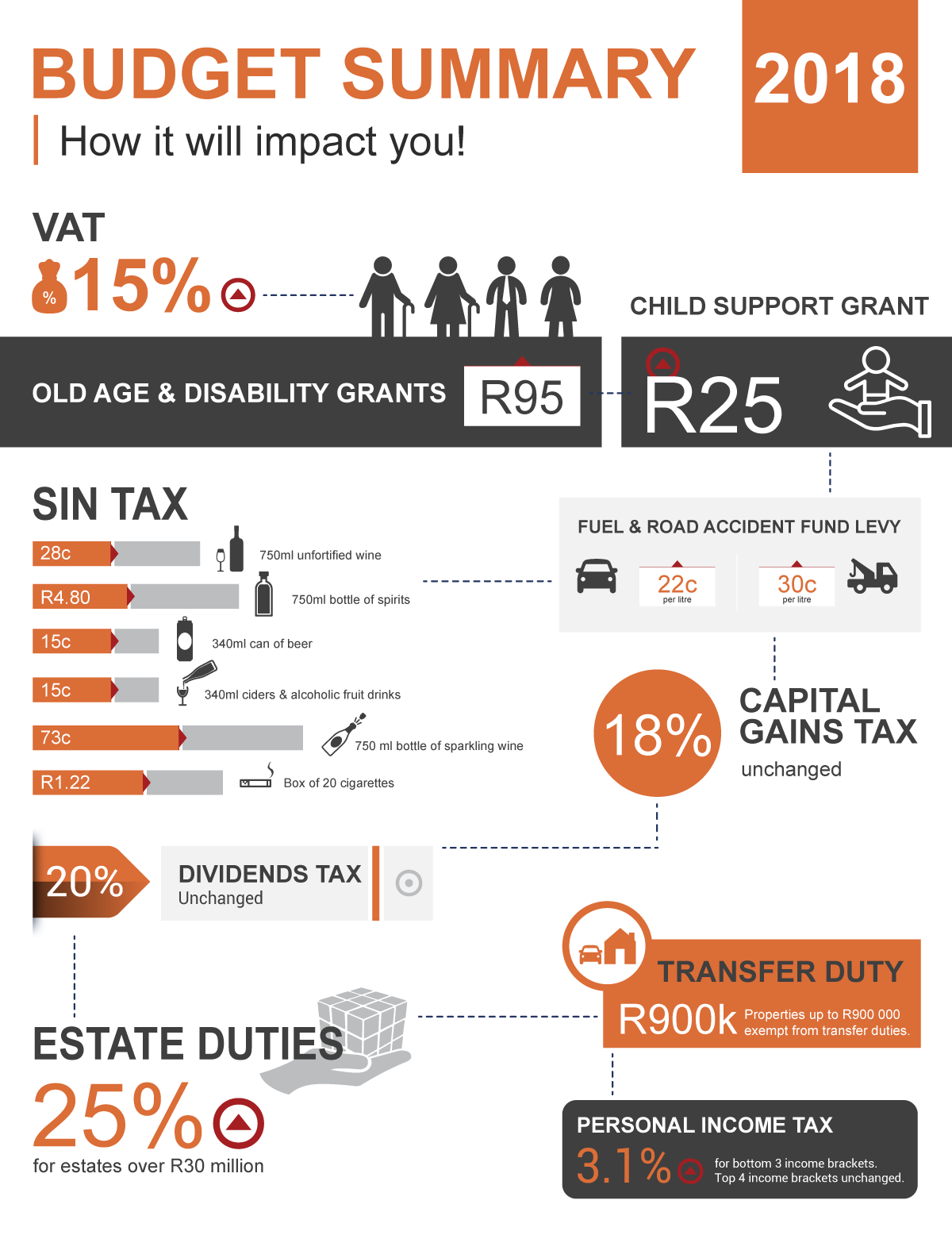

Executor’s remuneration is subject to VAT where the executor is registered as a vendor.

Where the value of the estate exceeds R3.5 million, estate duty will become payable on the balance in excess of R3.5 million, with the exception of the property bequeathed to a surviving spouse, which is exempt from estate duty and/or capital gains tax.

Land

Section 3 of the Subdivision of Agricultural Land Act prevents the subdivision of agricultural land, and such land being registered in undivided shares in more than one person’s name is subject to Ministerial approval.

Minor children

A minor child is a person under the age of 18 years of age. Any funds bequeathed to a minor child will be held by the Guardian’s Fund, which falls under the administration of the Master of the High Court. These funds are not freely accessible, and are usually invested at below market interest rates. It is thus advisable to provide for minors by means of a trust.

Member’s interest

The Close Corporations Act provides that, subject to the association agreement, where an heir is to inherit a member’s interest (in terms of the deceased’s Will), the consent of the remaining members (if any) must be obtained. If no consent is given within 28 days after it was requested by the executor, then the executor is forced to sell the member's interest.

Estate duty

Section 3(3)(d) of Estate Duty Act determines that where an asset is transferred to a trust during an estate planner’s lifetime, yet the estate planner, as trustee of the trust retains such power as would allow him to dispose of the trust asset(s) unilaterally for his own or his beneficiaries' benefit during his lifetime, then such asset(s) may be deemed to be property of the estate planner and included in his estate for estate duty purposes.

In community of property

Where the parties are married in community of property, the surviving spouse will have a claim for 50 percent of the value of the combined estate, thus reducing the actual value of the estate by 50 percent. The estate is divided after all the debts have been settled in a deceased estate (not including burial costs and estate duty, as these are the sole obligations of the deceased and not the joint estate). Only half of any assets can be bequeathed.

Life insurance

The proceeds from life insurance policies can be used to:

- Generate income to maintain dependents while the estate is dealt with;

- Pay estate expenses: funeral, income tax, estate administration, estate duty.

All proceeds of South African “domestic” policies taken out on the estate planner’s life, where there is no beneficiary nominated on the policy, will fall into his estate on his death.

Where a beneficiary is nominated on the policy, the proceeds will be deemed property for estate duty purposes, even though they are paid directly to the beneficiary (subject to partial exemptions based on policy premiums).

Policies which are exempted from inclusion for estate duty purposes are buy and sell, key man policies, and those policies ceded to a spouse or child in terms of an antenuptial contract.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)